India has been rapidly changing and improving for the better. From excelling in the space world to finances, this country has continuously been making headlines for all the right reasons. One such change took place a few years back in the name of GST – Goods and Services Tax. Now, this news has created a lot of buzz, some positive and some negative. But now, we all have come to terms with this taxation system. Still, so many sectors and aspects need clarity in our minds. One such topic is GST in the e-commerce sector and the impact it has.

What is GST?

As we already discussed, GST stands for goods and services tax that the central government imposes on all goods and services. Though these taxes were imposed previously as well under various names, with GST, all the taxes related to the buying and selling of goods and services came under one umbrella. So now whenever you buy something, you need to pay a little extra, which is considered a tax, typically assumed in every invoice and billing procedure. These taxes are the main sources of money that the government uses to create roads, public hospitals, and others.

The E-Commerce Sector

Recently, we have all been loving e-commerce because of the sheer convenience it offers. But with the growing e-commerce world, there is also a need to understand more about taxes and tax rules in this sector.

Why GST for E-Commerce?

GST helps make things fair. Imagine buying a book from a local store and paying tax. If you buy the same book online, why should it be different? GST ensures that all sales, whether online or offline, follow the same tax rules.

Challenges for E-Commerce Platforms

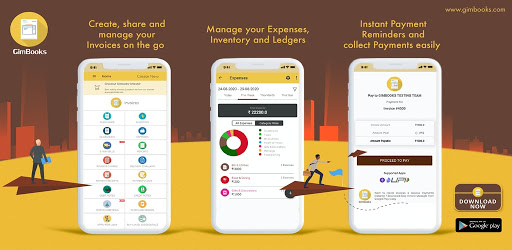

E-commerce companies need to understand GST rules. They must collect taxes from customers and pay them to the government. This process requires proper accounting using a GST invoice app and an understanding of tax rates. Sometimes, different products have different tax rates, making it complex.

What are the Benefits for Consumers

Customers always have some benefits and this time it is quite different. Prices become transparent, with taxes clearly mentioned. Moreover, when companies pay taxes, governments get funds to improve public services. In the end, consumers benefit from better roads, schools, and healthcare.

Compliance and Technology

E-commerce platforms use technology such as a GST billing app to manage GST. They develop systems to calculate taxes automatically when customers make a purchase. This technology ensures that companies follow GST rules correctly, reduces errors, and makes the process efficient.

International E-Commerce and GST

When people buy things from other countries online, GST still applies. However, international e-commerce brings additional challenges. Various countries have various tax rules. Companies need to navigate these rules carefully to avoid legal issues and ensure compliance which can be done better with a tax invoice bill maker.

Conclusion

GST has a really important role in the e-commerce sector. It ensures fairness by setting clear tax rules for online sales. While challenges exist, technology helps companies navigate GST efficiently. For consumers, GST promotes transparency and supports public services. As the digital economy continues to grow, understanding and managing GST will remain vital for e-commerce platforms worldwide.