Personal loans are one of the easiest and most handy ways to get money when someone is in need. They can cover various payments, for instance, weddings, medical bills, home repairs, and loans for business. And here’s the plus point, the money goes straight to your bank account so that you can use it quickly.

Some lenders are lightning-fast, getting you the money as soon as the next day after approval. And we are talking about same-day personal funding.

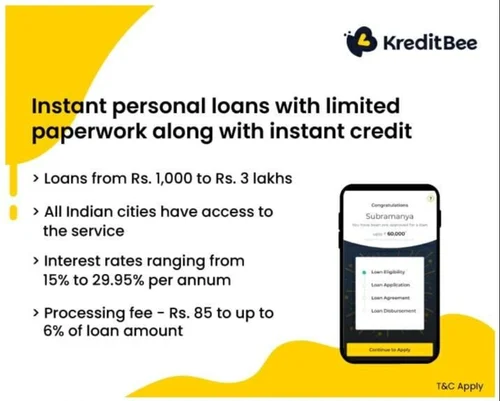

When we try to get these loans, we mostly look into these factors: interest rates, fees, how much you can borrow, and how long you have to pay it back. We also checked how the money gets to you, whether there are any discounts for automatic payments, the quality of customer service, and how fast you can get your hands on the cash with an instant loan.

Understanding same-day funding:

Sometimes, we face unexpected financial emergencies. At that time, we need money, and we need it fast. Same-day funding personal loans are made for that. They are the loans that can be approved and put in your bank account on the same day you apply. It’s the financial solution you turn to when you are in a pinch.

Types of personal loans with same-day funding:

These loans aren’t one-size-fits-all. You will mostly find same-day funding in personal loans, payday loans, and emergency loans. They are tailor-made to provide quick cash when you are dealing with an urgent financial situation.

Online lenders:

Online lenders are the driving force behind same-day funding personal loans. They have transformed the loan application process, which makes it super useful. You can apply from anywhere, get approved in very little time, and have the money in your account within hours with an online loan app.

Need to meet eligibility checklist:

While same-day funding may sound like a financial lifeline, it doesn’t come free. Lenders have some criteria you will need to meet. They want to ensure you are in a position to repay the loan without any problems. Mostly, they will check your credit score, look at your income, and ask for some documents to confirm your financial situation.

The speed vs cost dilemma:

Now, here’s the catch. Same-day funding comes with a trade-off. It’s quick, but it might cost a bit more. Since lenders need to process everything in a hurry, they might charge a little extra in interest. It’s the price for the speed and convenience.

Alternatives to same-day funding:

Same-day funding personal loans are a fantastic option when you need cash quickly, but they are not the only solution. Credit cards or a line of credit can also provide fast access to funds. It all depends on your specific situation and which option makes more financial sense for you in the long run.

How to apply for same-day funding:

The application process for same-day funding is very smooth. Most lenders have user-friendly websites or apps that guide you through the process. You will typically need to provide personal information, details about your income, and sometimes documents like pay stubs or bank statements.

Wrapping up,

Same-day funding personal loans are there to help you quickly when you face unexpected money issues. They are the fastest solution for an instant personal loan. But be careful with your borrowing, manage your budget well, and remember that same-day funding is like a reliable financial friend when you are in a bind.