Are you trying to find the perfect equity stock to invest in? Have you been hunting and scouring for a while now, hoping to one day find the perfect stock that makes you an overnight success?

Transforming stock or equity research into a thrilling adventure, we’ll uncover the hidden gems and promising treasures that await you. Treating investing like a scavenger hunt makes the process more engaging and definitely more rewarding in the end.

By the end of this article, you will have learned how to scout out promising stocks in the vast landscape of publicly traded companies.

Step no. 1

Define the parameters of your hunt. What type of stock or equity investment are you looking for – Common stock, Large-cap stock, Mid-cap stock, Small-cap stock, Growth stock, and more? Which stocks are right for your portfolio? What industry sectors are you interested in – technology, healthcare – and with that, what is your risk tolerance?

Step no. 2

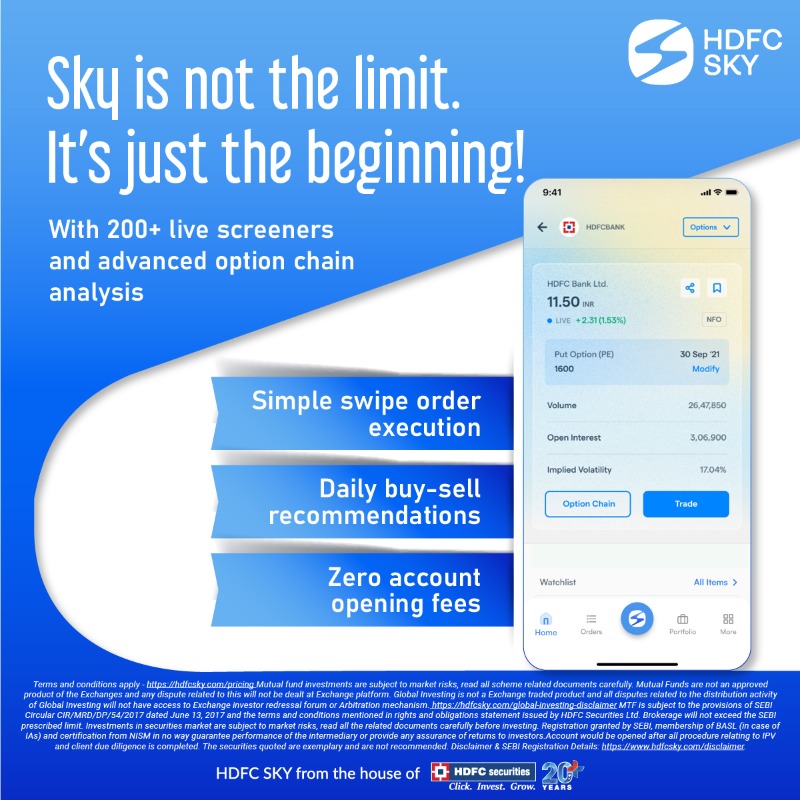

Be equipped with the right tools and resources to find the right stock, equity or F&O. From financial websites, investment forums, research reports, and market analysis tools – the unlimited access to information serves as your guide as you navigate the vast expanse of the stock market. Downloading apps and using other platforms can also work very well in your favor.

Step no. 3

Next, search through stock screeners to identify companies meeting your criteria. Filter and scavenge for metrics such as price-to-earnings ratio, dividend yield, equity derivatives, profit margins, revenue growth, etc.

Identifying promising sectors poised for growth and scouring news articles and market trends keeps you in step with the next part of your hunt.

Step no. 4

A good intraday trading app helps you delve into company fundamentals, examining key metrics such as revenue growth, earnings potential, and competitive positioning. Look for signs of undervaluation or overlooked opportunities that could lead to significant returns. Read the last few annual and quarterly reports. Analyze important indicators like cash flow, debt load, and return on equity. Make sure there are no red flags.

Step no. 5

By now, you will have a few contenders. Review your scavenger hunt notes and compile the strengths and weaknesses of the remaining prospects that you will be doing intraday trading for. Weigh your models, estimates, and qualitative assessments. Construct projected financial models based on your analysis. Estimate future revenues, earnings, and cash flows. Build an appropriate margin of safety. With rigorous analysis and fundamental research, you can uncover overlooked investment opportunities Wall Street has yet to fully appreciate.

Step no. 6

Celebrate your wins. Remember: when you trade intraday or invest for the long term there are thousands and thousands of potential investment opportunities available. The stock market is ever-changing, and flexibility is key to staying ahead of the curve. The excitement of discovering long-term investments that fit your strategy makes your stock market hunt worthwhile.

Conclusion

Transforming stock research into a thrilling adventure, you can unlock the secrets and potential riches that lie uncovered within the vast expanse of the stock market. So, gather your courage, sharpen your research skills, and embark on your journey for investment opportunities for online intraday trading journey- the adventure awaits.