One of the most important aspects of personal finance is managing daily spending and online payment. Saving even a small amount monthly on expenses might add up over time and improve your financial situation. We will examine practical methods for cutting costs on daily expenses in this article. We will provide you with practical advice on lowering your costs and raising your savings, from smart shopping strategies and budgeting advice to adopting frugal habits and using technology like an upi payment app. Using these tips, you can take hold of your finances, meet your financial objectives, and create a more secure financial future.

- The first step in saving money is to consider your current spending. Record every penny you spend via online payment, including normal monthly payments and purchases for groceries, baby products, and other items. Using a paper, an Excel spreadsheet, or an online tracker, record your expenses as is easy for you. Once you have your data, group the figures into mortgage, petrol and groceries categories and total each sum. Make sure you add everything to the list by assessing your bank and credit card statements.

- You can work on a budget now that you understand how much money you spend each month. Your budget should explain how your expenditure compares to your income to organize your spending and prevent overspending. Don’t forget to account for costs that happen frequently but not all the time. Include a savings point in your plan, and try to save money up to where it initially feels comfortable.

- Pay attention to how you spend your money. This can be easily done if you use a payment app for all of your purchase. Consider whether a purchase fits your requirements and priorities before buying one. Avoid making impulsive purchases and give yourself enough time to decide whether the item is necessary or if there are other, more affordable options. You may reduce wasteful spending and save money by being mindful of your purchasing decisions.

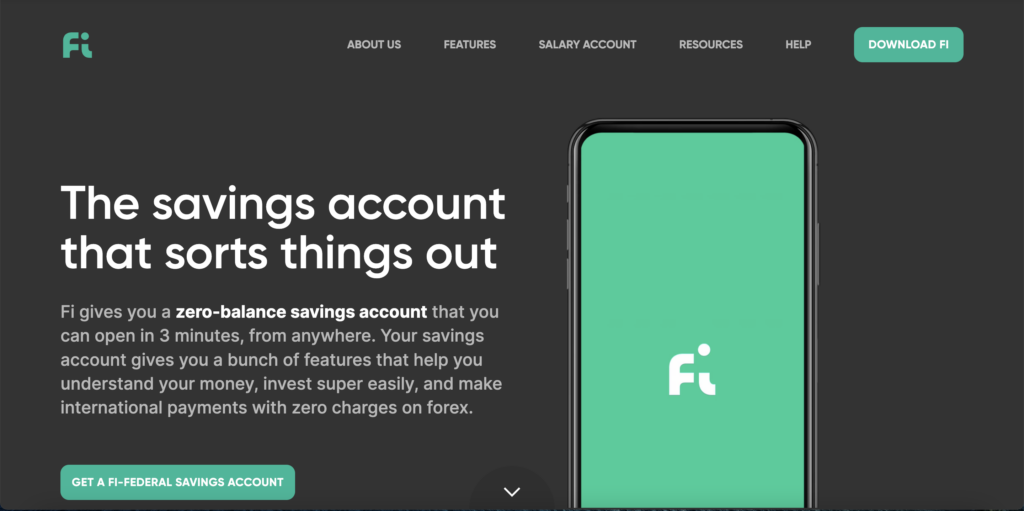

- Adopt frugal living by forming economical routines and procedures. Try to open online bank account and save money each month, such as becoming more energy and water efficient. Eat less at restaurants and prepare meals at home more frequently. Accept DIY projects to save money on home repairs and upkeep. Instead of buying new things, borrow from friends or neighbors or share existing ones. You may save costs and raise your savings by developing a frugal mindset.

- Automatic deposits between your savings and checking account are at your fingertips. The timing, amount, and location of money transfers are up to you. You can split a direct deposit to ensure some of your paycheck gets into your savings account. The benefit of doing so is that you don’t have to consider it and are less likely to spend the money on something else. Credit card incentives and spare change programmes, which round up transactions and send the difference into a savings or investing account, are two more simple savings strategies.

Conclusion:

Saving money on regular expenses is a great approach to strengthen your financial situation. Keep in mind that even little adjustments to your regular expenditure, like using a upi payment app and tracking expenses, can have a big impact on your financial situation. Maintain discipline, track your progress, and recognise each milestone in your savings. Using these techniques, you can increase financial stability, get closer to objectives, and lay a strong basis for a better financial future.