Why have millions of Indians looking for quick and simple credit access now turn to personal loan apps? In a nation where conventional banking sometimes requires labor-intensive procedures, these lending apps in India have changed the borrowing process. They meet the changing wants of modern consumers by being quick, easy, and flexible. But exactly what differentiates them and creates their popularity? Let’s now explore the main causes of the success of several financial instruments.

1. Instant Financial Access

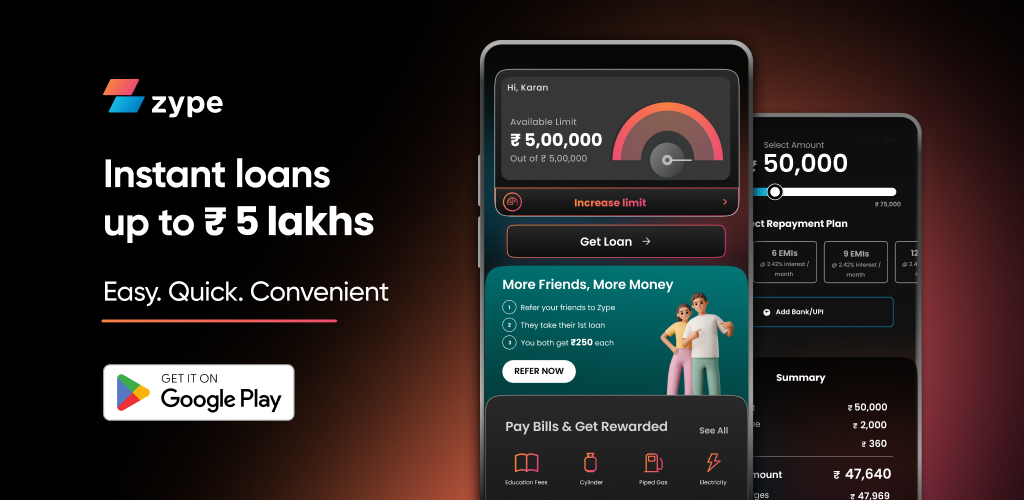

Personal loan apps India have become quite common mostly because they allow quick access to funds. Conventional banking methods often call for multiple in-person visits, lots of documentation, and long approval procedures.

Loan apps in India, on the other hand, simplify this process so users may apply for a loan and get approved in minutes. These apps are perfect for crises or unanticipated expenditures since borrowers may get funds when most needed with only a few taps on their cellphones.

2. Perfect Experience and Easy Interface

Personal loan apps developed in India are meant for the user. These programs have simple layouts that walk users through the application process systematically. From loan application to payout, the flawless experience makes navigating the app simpler for even non-tech aware individuals. These loan applications guarantee that the borrowing experience is seamless and hassle-free with features including pre-filled forms, simple document uploads, and real-time tracking.

3. Adaptable Loan Alternatives

The freedom personal loan applications in India provide is yet another major benefit. These apps address a wide variety of financial needs, from a small amount to meet a temporary need to a more large loan for a major purchase. Loan amounts, tenures of repayment, and interest rates that best fit their circumstances are choices open to borrowers. Loan apps in India offer value to a wide range of users because they are flexible and allow users to make their own payback plans.

4. Less Documentation and Paperwork

The days of long verification processes and time-consuming documentation are over. In India, personal loan apps have significantly lessened the need for actual documentation. Most apps only need simple proof of things like name, income, and address, which can be uploaded right through the app. Usually producing same-day approvals, the digital verification procedure is quick and accurate. This makes paperwork a lot easier, which is a big reason why loan apps are so popular in India, especially among young workers and business owners.

5. Clear, competitive interest rates

The popularity of personal loan apps in India is significantly influenced by transparency. These applications let users make wise judgments by clearly stating interest rates, processing fees, and any other upfront charges. Many loan applications available in India also have reasonable interest rates, often below those of established banks. This combination of expense and transparency guarantees that users of these applications feel secure and comfortable.

6. Improved Privacy and Security Regarding Data

Personal loan apps in India have put in place strong security steps to protect users’ information as concerns about data security grow. Most apps utilize advanced encryption technology to preserve personal and financial data, ensuring that borrowers’ information stays confidential. This focus on security has helped create trust among users, hence improving the popularity of loan apps in India.

Conclusion:

Personal loan apps are becoming more popular in India, which is part of a larger shift toward digital financial services. These applications have democratized credit access by providing speed, ease, and flexibility not present in traditional conventional banking systems. Loan apps are only going to become more popular as more individuals welcome the digital revolution in India. Personal loan applications in India are enabling consumers to take charge of their financial destiny with just a few clicks on their smartphones, whether they are seeking fast money in an emergency or evaluating new financial opportunities.