Many people struggle with the problem of overspending in the world of convenient spending made possible by credit cards. As enticing as the offers and rewards may be, overseeing your costs inside the limits of your predefined credit constrain is basic to maintaining a strategic distance from additional charges and obligations. In the event that you ever discover yourself in a circumstance where your credit card bills have ended up overpowering your record books, do not stress. There are compelling procedures and financial apparatuses accessible to assist you explore these challenges and recapture control of your money related well-being.

- Pay Minimum Bill Amounts: When facing a financial crunch, paying the minimum bill amount becomes a viable short-term solution. This approach can save you from incurring late fees and prevent negative marks on your credit history. While not a recommended long-term practice, it offers temporary relief, allowing you to regroup and plan your finances more effectively.

- Prioritize High-Interest Cards: If you possess multiple credit cards with varying interest rates, it’s advisable to prioritize repaying those with higher interest rates first. By focusing on high-interest cards, you can strategically reduce your outstanding balances, saving money on interest payments in the long run.

- Explore Online Personal Loans: Online personal loans, often accessible through a loan calculator, emerge as a practical and convenient solution to settle your credit card bills. These loans typically come with lower interest rates compared to credit cards, providing a more financially sustainable option. By opting for an online loan, you can consolidate your credit card debt into a single, manageable payment, alleviating the burden on your monthly budget.

- Opt for Easy EMIs: To make the repayment process more manageable, consider dividing your credit card bills into easily payable EMIs (Equated Monthly Installments). This approach allows you to cover your dues without straining your finances, ensuring timely payments and preventing financial crises.

- Communicate with Your Lender: Open and honest communication with your credit card issuer is crucial when facing financial constraints. By reaching out to your lender and explaining your situation, you may find them willing to offer solutions. These solutions could include reducing late fees, waiving certain charges, or even providing options for cash loan or money loans tailored to your needs.

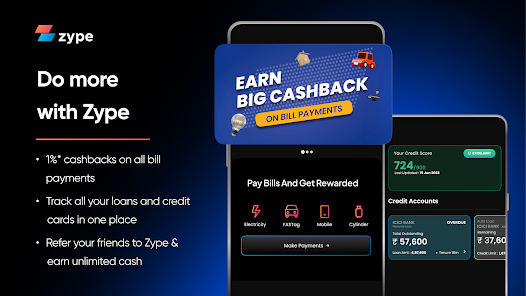

- Maintain Your Credit Score: Overspending and late payments can adversely impact your credit score, limiting your eligibility for future loans and financial opportunities. It is imperative to manage your credit responsibly to protect your credit score.

By implementing these strategies and employing financial discipline, you can not only settle your credit card bills but also safeguard your credit score. A healthy credit score opens doors to better offers on future loans, including an online loan and a personal loan, ensuring your financial stability in the long run.

In essence, while credit cards offer enticing benefits, responsible spending, strategic financial planning, and the judicious use of available tools such as online loan, cash loans, and money loan are indispensable in safeguarding your financial stability and securing a prosperous future. By employing these hacks and staying informed, you can navigate your credit card bills effectively, maintain a healthy credit score, and pave the way for a financially secure tomorrow.