In today’s fast-paced world, financial emergencies can strike when least expected. Whether it’s an unexpected medical bill, home repair, or a sudden travel expense, having access to quick funds can make a world of difference. This is where the advantages of quick approval for personal loan comes into play. Let’s delve into why these loans are gaining popularity and why they can be a lifeline in times of need.

1. Speedy Access to Funds:

One of the most significant advantages of quick approval for personal loans is the speed at which funds are disbursed. Traditional loans, such as those from banks, often involve a lengthy application process that includes extensive paperwork, credit checks, and weeks of waiting. In contrast, many online lenders and financial institutions offer personal loans with swift approval processes. Some loans can be approved within minutes, and you can receive the funds in your bank account in as little as one business day. This rapid access to cash is invaluable when facing urgent financial needs.

2. Convenience and Accessibility:

Quick approval personal loans through personal loan app are easily accessible online. Most lenders provide user-friendly websites and mobile apps that allow borrowers to complete the application process from the comfort of their homes. This convenience eliminates the need for in-person visits to a bank or credit union, saving time and effort.

3. Minimal Documentation:

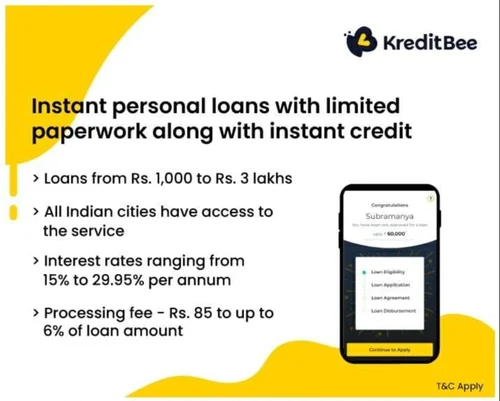

Unlike traditional loans that require an extensive list of documents, such as income statements, tax returns, and collateral, quick approval personal loans typically have minimal documentation requirements. Often, you only need to provide proof of identity, income, and bank account details. This streamlined process reduces the hassle and time spent on paperwork.

4. Flexible Use of Funds:

Instant loans obtained through quick approval can be used for a wide range of purposes. Whether you need to cover your health or medical expenses, consolidate debt, finance a vacation, or make home improvements, you have the flexibility to use the funds as you see fit. There are generally no restrictions on the loan’s purpose, allowing borrowers to address their unique financial needs.

5. No Collateral Required:

Most quick-approval personal loans are unsecured, meaning you don’t have to put up collateral, such as your home or car, to secure the loan. This reduces the risk of losing valuable assets in case you’re unable to repay the loan, which is a requirement for some other types of loans.

6. Debt Consolidation Benefits:

For those struggling with multiple high-interest debts, quick approval personal loans can offer relief through debt consolidation. By combining outstanding debts into a single loan with a lower interest rate, borrowers can simplify their finances and potentially reduce their overall interest payments.

In conclusion, quick approval for personal loans offers a lifeline to individuals facing financial challenges or those in need of immediate funds. The speed, accessibility, flexibility, and convenience of these loans make them a practical solution in times of urgency.

However, it’s essential to borrow responsibly and choose a loan that aligns with your financial situation and repayment ability. Always read and understand the loan terms and conditions to ensure you make the most of the advantages these loans provide.