Women need to save and invest more than men do because of things like longer life expectancy, gender pay gaps and taking time off to care for family. Money-saving tips, different savings schemes and investment for women can help them become financially independent, build wealth and prepare for emergencies. They can build a secure financial future, offering long-term safety and financial freedom.

Let’s learn about saving schemes, mutual funds for women and other Post Office Savings Schemes:

1. Mutual Funds

A Mutual Fund pools money from various investors and puts these funds into different assets such as equity, debt, gold, etc., depending on the specific scheme chosen by the investor. It is professionally managed and monitored by a fund manager whose goal is to generate returns for investors. These are market-linked instruments giving you the benefit of the power of compounding, therefore, don’t provide fixed returns. Returns vary as per the fund’s performance.

You can invest in mutual funds with Lxme which are well-researched, diversified and curated by experts.

There are various types of mutual funds, however, the main ones are:

Equity Mutual Funds

These mutual funds invest the pooled money from investors primarily in stocks/shares of different companies. Equity involves a higher amount of risk, however, it’s a long-term asset class where the risk is mitigated when you allow time for your money to grow, aim at generating inflation-beating returns and benefit from the power of compounding. You can invest in long term mutual funds with Lxme.

Debt Mutual Funds

These funds tend to invest in fixed-income instruments such as money market instruments, corporate and government bonds. These are suitable for short-term goals (less than 3 years). It’s an essential part of the overall asset allocation of the investor offering the benefit of the power of compounding. You can invest in short term mutual funds with Lxme.

Gold Mutual Funds

These are mutual funds that invest in gold and different gold-related assets including Gold ETFs on your behalf. They act as a hedge against inflation, and market uncertainties allowing investors to invest in gold in a smart way. You can invest in gold mutual funds with Lxme.

2. Sovereign Gold Bonds (SGB)

SGBs are issued by RBI on behalf of the Government of India, allocated in units where each unit is equivalent to 1 gram of gold. Capital gains arising from SGB’s are exempt from the Capital gains tax if the bond is held till maturity of 8. You can earn additional interest income of 2.5%p.a over and above capital appreciation/returns you’ll get from gold price rise.

3. Sukanya Samriddhi Yojana (SSY)

SSY is a government investment scheme in India aimed at supporting the financial future of girl children which will help parents save for their daughter’s higher education and other expenses. The prevailing interest rate is 8.2% p.a. compounded annually. It cannot beat inflation over the long term.

4. Public Provident Fund (PPF)

PPF is a government-backed savings scheme open to Resident Indians, parents can open an account on behalf of their child. It offers a fixed interest rate, currently at 7.1% p.a. which is compounded annually, and is revised every quarter by the government. PPF has a maturity period of 15 years, providing a secure investment option for long-term savings. It cannot beat inflation over the long term.

5. Mahila Samman Savings Certificate

This is a one-time small savings scheme for women and girls announced in Budget 2023. It will be available for 2 years i.e from April 2023 – March 2025. It offers a fixed interest rate of 7.5% p.a. compounded quarterly and allows a minimum deposit of Rs.1,000 and in multiples of Rs.100. It cannot beat inflation over the long term.

6. National Saving Certificate (NSC)

NSC is a savings option by the government that is backed by a fixed-income investment scheme offered by India Post. These certificates earn fixed interests to provide stable and long-term income. The prevailing interest rate is 7.7% p.a. compounded annually. It cannot beat inflation over the long term.

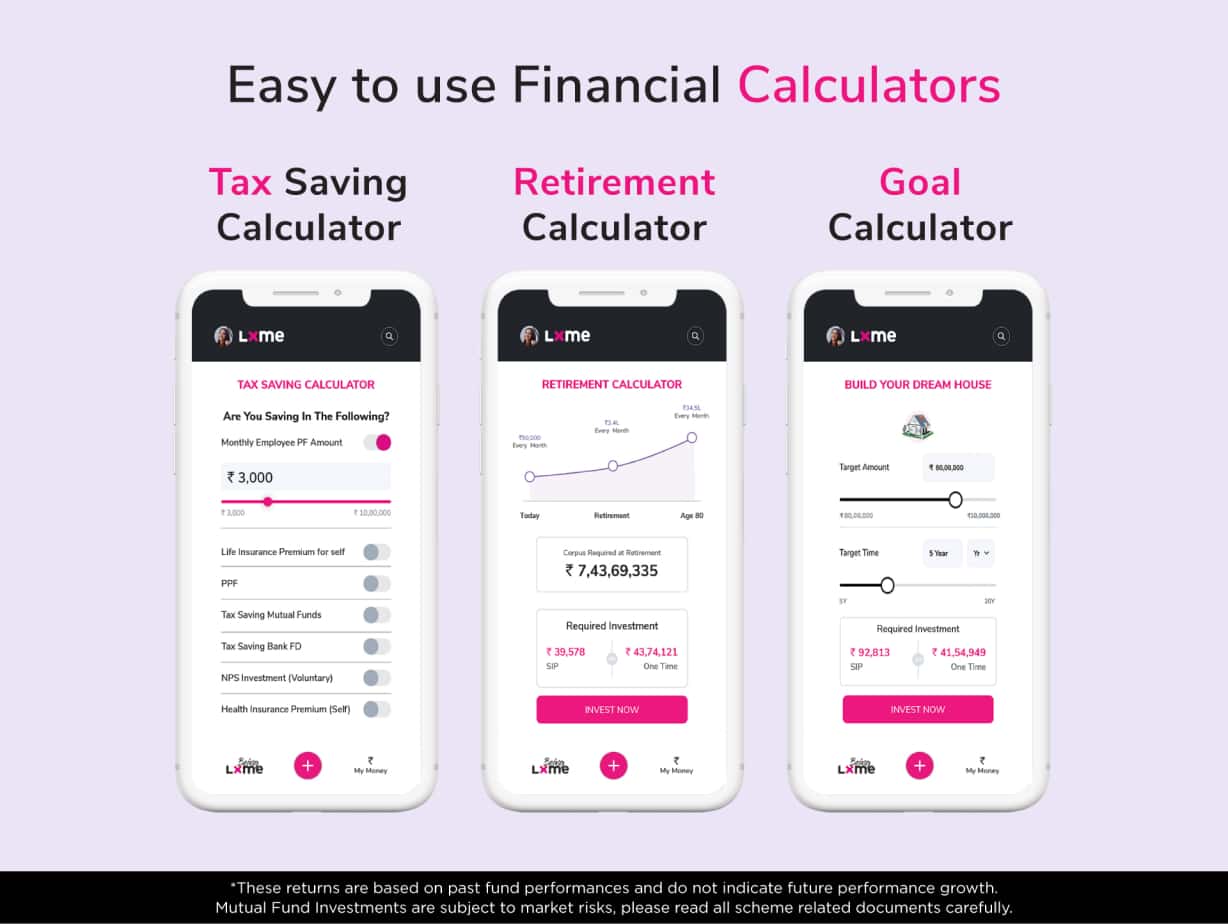

In conclusion, having a mix of different investment options is key for women to achieve financial security and independence. Diversifying your investments helps reduce risk and increase potential returns. By exploring different investment options, women can build a strong financial foundation. Check out Lxme, a finance app for women.

Start early, stay consistent, and take control of your financial future with Lxme’s goal and time based portfolios.